salt tax deduction explained

52 rows The SALT deduction is only available if you itemize your deductions. In New York the deduction.

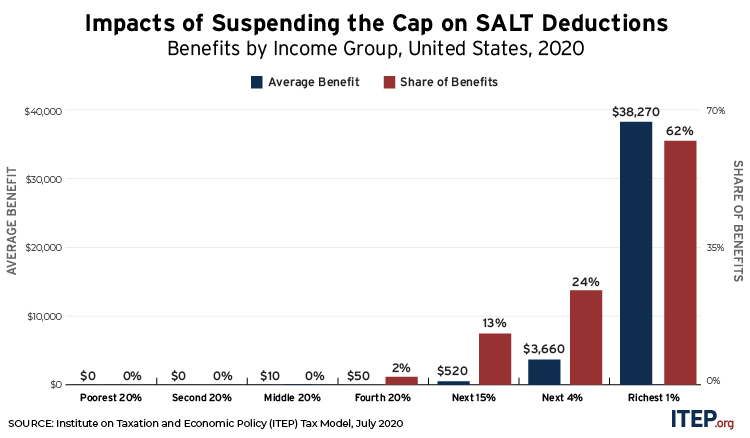

Why Democrats Are Fighting For A Tax Deduction That Mostly Helps The 1 Foundation For Economic Education

As incomes rise the loss in deductions can also be offset by the decrease of the top federal income tax rate from.

. SALT stands for the state and local tax deduction that taxpayers can claim when they dont take a standard deduction and choose to itemize instead. The tax plan signed by President Trump in 2017 called the Tax Cuts and Jobs Act instituted a cap on the SALT deduction. It allows those in high-tax states to deduct the money they spend on local and state taxes.

During initial talks about tax reform the SALT deduction was almost eliminated. The acronym SALT stands for state and local tax and generally is associated with the federal income tax deduction for state and local taxes available to taxpayers who itemize. The SALT deduction cap was introduced as part of the Tax Cuts and Jobs Act as a means to broaden the individual income tax base and partially fund reductions in statutory.

In tax years 2018 to 2025 the SALT deduction is. Ways the SALT deduction cap can be offset for high earners. This limit on state and local tax is often abbreviated to the SALT deduction cap and was temporarily set at 10000 for single and married filers and 5000 for married couples.

According to an explanation from the Tax Foundation SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local. The SALT deduction also generally benefits states that have relatively large numbers of high-income taxpayers and high-tax environments. After legislators realized the impact of this it was decided to simply reduce the SALT deduction to 10000.

A salt tax refers to the direct taxation of salt usually levied proportionately to the volume of salt purchasedThe taxation of salt dates as far back as 300BC as salt has been a valuable good. Accordingly the taxpayers 2018 SALT deduction would still have been 10000 even if it had been figured based on the actual 6250 state and local income tax liability for. The deduction went into effect during the 2019 tax year and included a cap of 10000.

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

State Local Taxes Salt Mortgage Deductions Explained

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

State And Local Tax Salt Deduction Salt Deduction Taxedu

New York State Budget Provides A Work Around To The Federal Salt Cap For Certain Business Entities

Salt Deductions Property And Income And Sales Tax Oh My

Democrats Push For Agreement On Tax Deduction That Benefits The Rich The New York Times

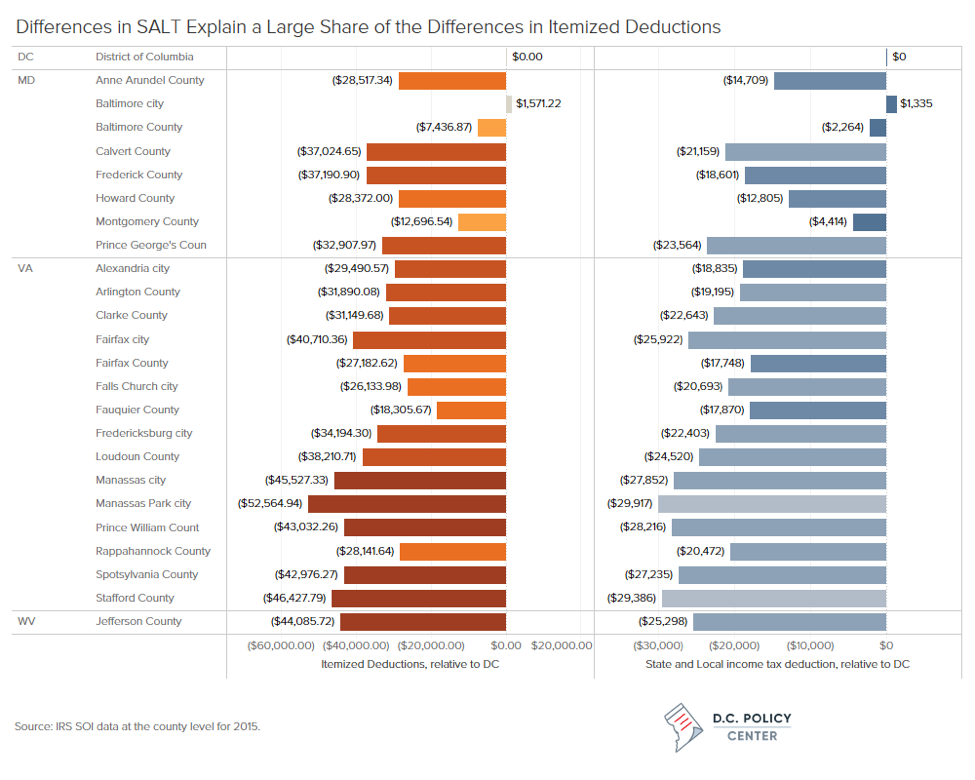

Elimination Of Salt Deduction Is Trouble For Dc S Future Population Growth D C Policy Center

Salt Cap Repeal Has No Place In Covid 19 Legislation National And State By State Data Itep

Property Tax Deduction Explained Quicken Loans

Repeal Of The State And Local Tax Deduction Full Report Tax Policy Center

10 000 Tax Deduction For State And Local Tax Salt Deduction Itemized Deductions Schedule A Youtube

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

State And Local Taxes What Is The Salt Deduction

Ohio Income Tax Ohio Jumps On Trend To Codify Salt Deduction Cap Workaround Buckingham Doolittle Burroughs Llc Jdsupra

Many Rich Fretting About Salt Didn T Get Break Before Trump Law Bloomberg

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/22441883/SALT_tax_deduction_poll_Data_for_Progress.png)

Salt Tax Repeal Democrats Weigh Restoring The State And Local Tax Deduction Vox

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy